How to Finance Your Home Health Aide Training

Embarking on a career as a home health aide (HHA) can be both fulfilling and life-changing. It is a great career choice and the job opportunities are endless.

However, for many, the cost of training is a significant hurdle. Fortunately, there are many creative ways to finance your home health aide training, ensuring that your dream job doesn’t remain out of reach due to financial constraints.

From free training opportunities to targeted funding options, let’s break down the steps to fund your certification.

Exploring Free Training Opportunities

Finding Free HHA Classes Near You

One of the quickest ways to jumpstart your career without incurring debt is to take advantage of free HHA training programs. These are often offered by healthcare facilities seeking to hire trained aides, as well as through various community organizations. Because the demand is great for HHA positions many agencies will train you for free AND give you a job!

To find free HHA classes in your area, you can utilize resources such as the free HHA classes near you directory. This database can provide information on local programs that can be accessed at no charge.

SNAP HHA Free Training

Another notable program is the SNAP Employment & Training initiative. If you are a recipient of SNAP benefits, you may be eligible for SNAP HHA free training. The initiative aims to help individuals gain marketable skills that will aid in long-term employment stability. By accessing this program, eligible candidates can get the training they need while continuing to receive SNAP benefits.

Funding Options for HHA Certification

Scholarships and Grants

Scholarships and grants present an excellent opportunity to finance your training without the need to repay the funds. Various organizations and foundations offer these financial aids specifically to those pursuing a career in healthcare, including home health aide professionals.

Available Grants and Scholarships:

- Healthcare Foundation Scholarships

- Vocational Training Grants

- Community College Scholarships

By researching these options and applying to several, you can potentially cover a significant portion of your training costs. It’s also helpful to visit the get HHA certified page for more information on the certification process along with any financial aid options they suggest.

Loan Programs and Repayment Plans

If scholarships and grants are not sufficient, loans are another viable option. Specialized loan programs exist that cater to students entering healthcare fields. Look for loans with favorable terms, such as low-interest rates or income-based repayment plans, which can make repayment more manageable.

Considerations When Exploring Loan Programs:

- Interest Rates

- Repayment Plan Flexibility

- Loan Forgiveness Opportunities

Understandably, it’s essential to ensure that you are able to meet the loan’s repayment requirements before committing to this option to avoid financial strain down the line.

State-Specific Financial Assistance

Understanding State-Related Benefits and Assistance

Each state may have specific programs designed to assist with the training and certification of home health aides. It’s important to explore state-sponsored benefits and financial assistance that might be available to you. This can range from direct financial aid to subsidized training programs.

The HHA state salaries and employment guide provides insights into regional benefits and the potential return on investment in your training.

Employment-Based Reimbursement Programs

One often-overlooked avenue is seeking reimbursement from potential or current employers. Many healthcare providers recognize the value of having certified home health aides and are willing to invest in their training:

Approaching Your Employer About Training Reimbursement:

- Research your employer’s policies on educational benefits.

- Prepare a proposal highlighting the mutual benefits of your training.

- Negotiate the terms of reimbursement, such as service periods post-training.

Having a clear discussion with your employer can lead to a mutual agreement that benefits both parties, with the employer gaining a skilled employee and you receiving free training.

Nursing homes are hiring HHA’s – don’t miss your chance!

Long-Term Financial Planning for HHA Training

Budgeting for Your Education

Budgeting effectively is key to funding your education without incurring excessive debt. It involves forecasting your training expenses, including tuition, course materials, and incidental costs, followed by planning your personal finances accordingly.

Budgeting Tips:

- Identify all potential training costs upfront.

- Create a savings plan leading up to your training.

- Explore part-time work to supplement your income during training.

Remember to include a contingency for unexpected expenses to ensure you’re financially prepared for your educational journey.

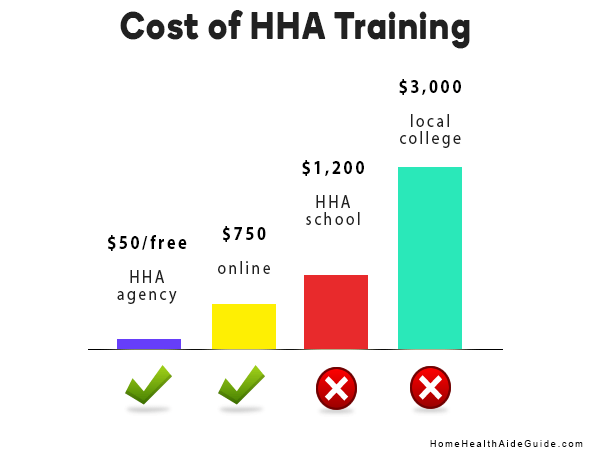

Investment in Online HHA Courses

The rise in online education provides another cost-effective way to pursue HHA training. Online HHA courses can be more affordable, flexible, and convenient, especially if you have other commitments. For individuals interested in this modern approach to learning, the HHA course landing page offers valuable information and access to various online training options.

By taking advantage of these resources and strategies, you can smoothly transition into a career as a home health aide without the burden of overwhelming costs. Proper planning, research, and dedication to finding financial support will pave the way for a successful and rewarding profession in home healthcare.

Key Takeaways

Key Takeaways for Financing Home Health Aide Training

| Financing Method | Key Points |

|---|---|

| Free Training Opportunities | Utilize free HHA classes or SNAP training programs to jumpstart your career without debt. |

| Scholarships and Grants | Seek financial aids from healthcare foundations and vocational training grants that do not require repayment. |

| Loan Programs and Repayment Plans | Consider loans with favorable terms for healthcare training, and ensure you’re able to commit to repayment plans. |

| State-Specific Financial Assistance | Explore benefit programs and financial aids specific to your state for training assistance. |

| Employment-Based Reimbursement Programs | Investigate options for your employer to cover training costs, benefiting both you and the healthcare facility. |

| Budgeting for Education | Prepare a comprehensive budget for your training, counting all costs and incidentals, to manage financials. |

| Investment in Online HHA Courses | Take online courses for affordability and convenience; visit the HHA course landing page for resources. |

Combining these methods can provide a comprehensive approach to financing your home health aide training, potentially saving you thousands and launching your career without the stress of financial burdens.